Every year, almost 60% of the UK population embarks on overseas holidays, with popular destinations including Spain, Italy, and Greece. Whether travellers seek relaxation on sun-soaked beaches, cultural exploration, or culinary adventures, they all want their holidays to be stress-free.

Customer behaviour is evolving. Whilst cash remains the most used payment method on holiday, only one in five uses cash only, and the majority rely on a combination of cash and cards. Regardless of the payment method, the travellers are facing several pain points. Travel Money providers need to innovate and make the experience more enjoyable. This all starts with good understanding of customers.

Nudging customers to plan in advance

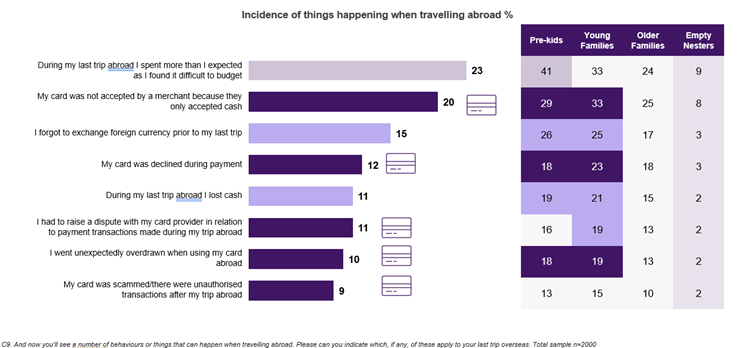

The research conducted by First Rate in May 2025 indicates that 15% of travellers forgot to exchange foreign currency before their last trip – but there are large generational differences. Amongst younger customers without kids and younger families. One customer in four forgot to purchase the foreign currency before departure.

Conversely, for older, more seasoned travellers, exchanging foreign currency is now an ingrained habit, with only 3% of empty-nesters aged above 45 forgetting this step. Some customers are looking forward to arranging their travel cash as it means that their holiday is approaching. These customers are also more proactive when shopping around for the best FX rates.

Despite the rise of digital payments and the popularity of cards in Europe, cash remains a crucial payment method abroad, with 79% of travellers utilising cash for various reasons. Cash may still be required in certain instances, from tourist taxes in Italy, local taxi rides, or boat trip tickets. Travellers without cash may miss out on the experience, or they will have to spend precious time looking for local ATMs. We know that 41% report having made at least one ATM withdrawal during their overseas trip. Many of them are charged ATM withdrawal fees that vary depending on the ATM provider so it is not easy to know the cost in advance.

Card payments abroad

While card usage during overseas holidays is on the rise, card acceptance remains a significant concern. One in five travellers has faced situations where merchants only accept cash. Although card acceptance is robust in high-end hotels and popular tourist hotspots, younger, budget-conscious travellers are more likely to experience this issue.

Additionally, 12% of travellers have experienced declined transactions while abroad, with the decline being more common for younger segments who are almost twice as likely to be declined.

Besides the acceptance of their cards, card security and fraud prevention continue to concern many travellers. Almost 9% of customers report that their card was scammed, or that there were unauthorised transactions after their trip abroad. And more than 1 in 10 had to raise a dispute with their card issuers in relation to a payment transaction overseas.

Travel Money provider should be better at explaining the benefits of having a dedicated travel card. This can help customers protect their day-to-day banking and ensure that their account in not compromised and they can pay the bills when they return from holidays.

Increasingly offering a travel card is not enough. Travel Money providers must provide more guidance on how to use it. For example, adding the payment card to a digital wallet can improve the customer experience. The digital wallets are using biometric information for extra security and can also reduce the risk of card being declined at the point of sale. They also offer a more seamless experience without the need to enter a PIN, even for higher value transactions above the contactless limit.

Offering control and budgeting

Under the holiday spell, it is not always easy to stick to one’s budget. More than one in five (23%) spend more on holiday than expected. The younger segments, especially pre-kids and young families, struggle most with budgeting; one in five found their card unexpectedly overdrawn abroad.

Cash is a very good budgeting tool, but as merchants are adopting digital payments, customers need a digital way to control spending.

Travel Money providers understand that, and the majority now offer digital multicurrency travel cards to their customers. Customers can still be in control and, at the same time, manage their holiday spending easily. No need to track expenses. Simply transferring their budget to the ringfenced prepaid card, ensuring you cannot overspend

Source: First Rate research conducted by Jigsaw/Strat7

N= 2000 customers who travel overseas.

Field work conducted in April, May 2025

Notes:

- Payments statistics: first half of 2024 At the end of the first half of 2024 the total number of automated teller machines (ATMs) in the euro area had decreased by 3%